Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-10-14

Infinite scenery on the dangerous peak! 4200 can’t stop it

Gold will continue to rise, pay attention to 4200 in the short term, the limit is 4250! The internal gold price is around 950 and 980! Gold has gone from 3,800 before the holiday to 4,150 now, rising by more than 300 US dollars in just two weeks. Of course, th...

![[Today’s Focus] Gold and silver are unstoppable, TACO trading helps US stocks re](/uploads/allimg/xm-forex-suo/33.jpg)

market analysis2025-10-14

[Today’s Focus] Gold and silver are unstoppable, TACO trading helps US stocks re

Gold and silver hit all-time highs simultaneously on Monday, US stocks rebounded sharply, and TACO trading reappeared. TACO (TrumpAlwaysChickenOut) was first proposed by the American media. The literal translation is "Trump always shrinks from battle", and the...

market analysis2025-10-14

The U.S. government prioritizes allocating funds to ensure military personnel’s

On October 14, spot gold was trading around US$4,114.42 per ounce. Gold prices once again hit a new all-time high of US$4,116.87 per ounce on Monday, affected by renewed tensions in trade relations and expectations of a U.S. interest rate cut. U.S. crude oil w...

market analysis2025-10-14

On 10.14, gold and silver alternately rose and closed as expected, and fell back

Your profits come from other people‘s losses. In other words, when someone makes a mistake, profits will appear in the market that can be earned, but you cannot calculate or predict how many people will make a mistake next, or how big of a mistake they will ma...

market analysis2025-10-14

Foreign exchange practical strategy on October 14

U.S. dollar index: The U.S. dollar index‘s rise on Monday was blocked below 99.35, and its decline was supported above 98.80, which means that the U.S. dollar is likely to maintain a downward trend after a short-term rise. If the U.S. index‘s rise today encoun...

market analysis2025-10-14

10.14 How to solve the short-term trap when gold continues to rise? The latest o

There are always four levels in the investment market: preserving principal, controlling risks, earning income, and long-term stable and sustained profits. Don‘t decide the outcome based on one day‘s winning or losing. Whether making money is accidental or ine...

market analysis2025-10-14

The Beige Book and Powell’s speech are coming, and the two reports stir up inter

XM Forex Market Forecast: The Beige Book and Powell‘s speech are coming, and the two reports have stirred up international oil prices. XM Chart At 2:00 this Thursday, the Federal Reserve will publish the seventh Beige Book of the year. This Beige Book will rev...

market analysis2025-10-14

Is the Swiss franc's "0.80 offensive and defensive battle" reaching the top, or

On Monday (October 13), the US dollar against the Swiss franc traded above the 0.8000 integer mark during the European session. After the exchange rate‘s rapid retracement of nearly 1% last Friday, there was no sustained selling pressure at the beginning of th...

market analysis2025-10-14

The short-term rebound of the US dollar cannot change the long-term pressure, an

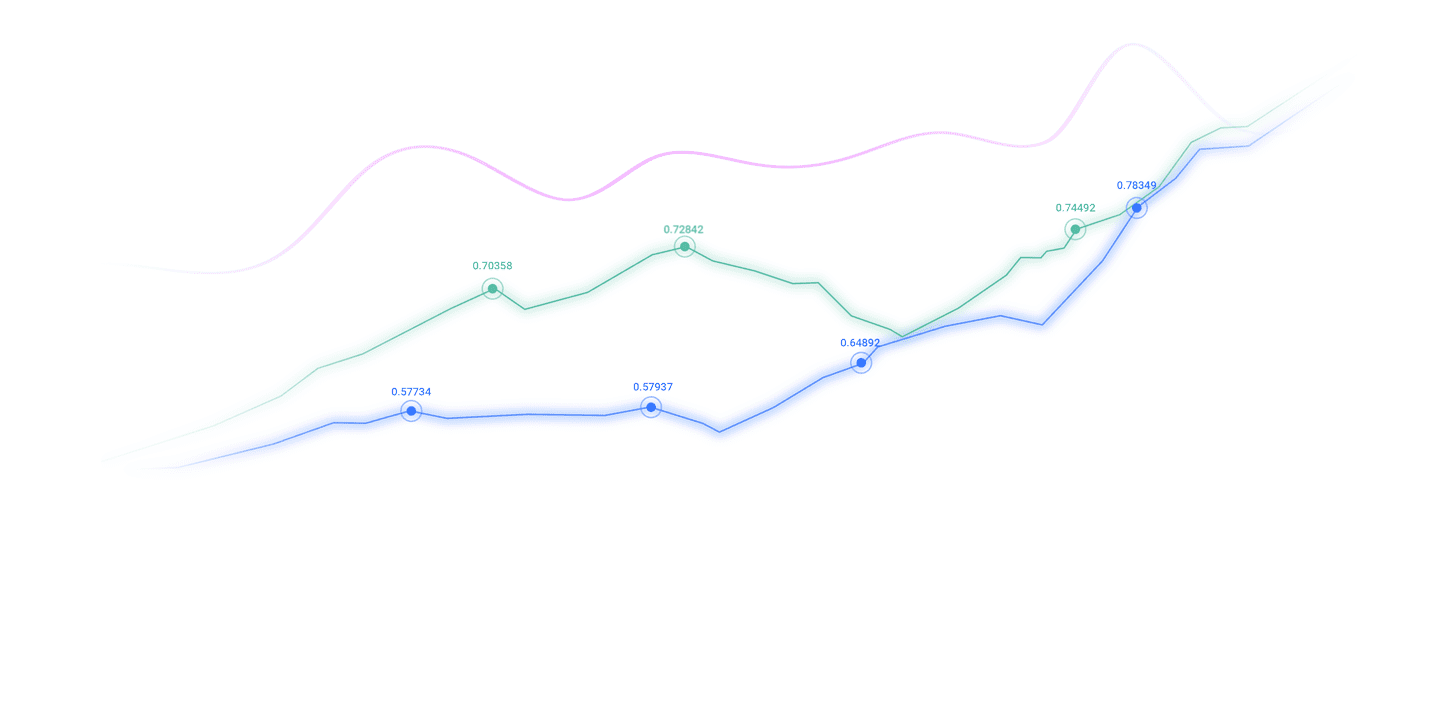

From our trading perspective, the U.S. dollar may still be in an overvalued range, and its fundamental support is gradually weakening. Of the 33 currencies covered by our valuation model, only 9 are valued at a higher level than the US dollar. As the advantage...

market analysis2025-10-14

The U.S. government shutdown has entered a "blowing period", and the bond and fi

On Monday (October 13), the U.S. dollar index strengthened during the day, while spot gold simultaneously touched $4,073.81 per ounce. This pattern of rising together is quite rare in the short term, reflecting that the market‘s risk aversion preference still ...

market analysis2025-10-14

Why did the U.S. Treasury Department's 20 billion bailout create greater hidden

On Monday (October 13), the foreign exchange market got off to a stable start amid the aftermath of the weekend news. The U.S. dollar index was last at 99.1019, up 0.28% from the previous trading day. The slight gain reflected investors‘ cautious return to glo...

market analysis2025-10-14

The U.S. dollar index rebounded, with Federal Reserve Chairman Powell, RBA meeti

The U.S. dollar index hovered around 99.35 in Asian trading on Tuesday, with the greenback rising against the euro and yen on Monday after a shift in rhetoric from U.S. President Donald Trump eased tense trade relations. This week will see many Federal Reserve...

market analysis2025-10-14

Risk aversion deepens and hits new highs, gold and silver sun extends lower

Yesterday, the gold market continued its upward trend driven by risk aversion. After opening low at 4008.9 in early trading, the market fell back first. The daily low reached 3993.8, and then the market fluctuated strongly and rose. After breaking through the ...

market analysis2025-10-13

Gold hits record high again as Trump threatens to impose tariffs again, weighing

Markets started the week on a cautious note after U.S. President Donald Trump announced late on Friday that he would impose 100% tariffs on Chinese imports. There won‘t be any high-level data released on Monday‘s economic calendar, so risk sentiment will remai...

market analysis2025-10-13

Will gold rise to 5,000 before 2030?

Gold will rise to US$5,000 or even US$10,000 before 2030. You heard it right. Goldman Sachs Group and Bank of America jointly believe that gold will rise to US$5,000 before 2030, that is, in the next five years! Of course, what is even more exaggerated is that...

CATEGORIES

News

- Risk aversion deepens and hits new highs, gold and silver sun extends lower

- Trump's latest tariff threat accelerates the influx of safe-haven assets, and th

- De-dollarization is unstoppable! CPI may be unable to recover in September

- It was not Powell who judged the case, but PCE. The life of the US dollar was re

- US large non-farm expectations in August are pessimistic, US dollar index may be

- Hamas signs Gaza ceasefire agreement, US Bureau of Labor Statistics prepares to