Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-11-20

U.S. non-farm payrolls hit in September, U.S. index breaks through 100 mark

XM Review: The US non-farm payrolls are coming in September, and the U.S. index breaks through the 100 mark. XM Review: At 21:30 today, the US Department of Labor Bureau of Labor Statistics will reissue the September non-farm employment report. The September n...

market analysis2025-11-20

Analysis of the latest trends in gold, US dollar index, Japanese yen, euro, Brit

In terms of basic news on Thursday (November 20), the U.S. dollar index maintained a strong trend and is currently around 100.25; spot gold is around $4,080 per ounce. On this trading day, investors will focus on the U.S. non-farm payrolls report, which is exp...

market analysis2025-11-20

Gold, is the rally over?

The 2025 Financial Expo will be held in Shenzhen. Friends in the industry have gathered together after many years. It is indeed not an easy task to stay in the same industry for more than ten years. In the blink of an eye, 16 years have passed, and there is no...

market analysis2025-11-20

The decisive battle lags behind non-agriculture! Employment may pick up in Septe

Asian Market Trends On Wednesday, boosted by risk aversion and expectations that the Federal Reserve may remain on hold in December, the U.S. dollar index strengthened for the fourth consecutive trading day, standing above the 100 mark, hitting a new high in t...

market analysis2025-11-20

Fed meeting minutes reveal serious differences, non-farm payrolls are coming ton

On November 20, in early trading in the Asian market, spot gold was trading around US$4,050 per ounce. The gold price benefited from the expected probability of an interest rate cut in December, which had dropped to 30%. At the same time, policymakers were div...

market analysis2025-11-20

Weakening British inflation and U.S. policy uncertainty jointly put pressure on

GBP/USD continued to fluctuate at low levels during the Asian session on Wednesday, trading around 1.3150, under pressure for the fourth consecutive trading day. The market has generally turned its attention to a number of British inflation-related data in Oct...

market analysis2025-11-20

The U.S. dollar index held steady, as the U.S. AI sector worried about the direc

In early European trading on Wednesday (November 19), the U.S. dollar index edged up 0.16% to around 99.74. Judging from the time-sharing chart, the U.S. dollar index showed a strong rebound trend of first declining and then rising, and the overall bullish mom...

market analysis2025-11-20

Will the U.S. economy enter the dangerous zone of "boiling a frog in warm water"

Analysts predict that U.S. real GDP is expected to grow at an average annual rate of 2.3% in 2026. This growth rate is slightly higher than the potential growth rate, but not to the extent of "overheating" and more like a "medium-speed" expansion. Supporting t...

market analysis2025-11-20

The gold dollar has risen simultaneously again, and one of gold and equity is ly

During the Asia-Europe session on Wednesday (November 19), spot gold rebounded after opening slightly after hitting the bottom. The U.S. dollar index held on to a one-week high and continued to rebound under the overall easing atmosphere of European inflation....

market analysis2025-11-20

The yen broke through the 155.5 mark! There are two "culprits" behind the lack o

During the Asia-Europe session on Wednesday (November 19), the U.S. dollar continued to fluctuate upward against the yen, while the yen continued to depreciate and is currently trading around 155.59. Japanese Prime Minister Sanae Takaichi‘s expansionary fiscal...

market analysis2025-11-20

EURUSD is on the eve of a change

Wednesday, November 19th. Against the background that major economies are about to usher in a series of key data and central bank information disclosures, the EURUSD fluctuated within a narrow range around 1.1580 during the North American session, not far from...

market analysis2025-11-20

11.20 Gold fluctuates and falls, crude oil rises strongly, latest market trend a

As an investor, you should know that investment cannot be without risks. If you don‘t follow the rules of the game, you will be out sooner or later. There is no such thing as winning in every move, and there is no transaction that fails in every move. What we ...

market analysis2025-11-20

The U.S. index rises as the Fed sings, while gold and silver are short-selling

Yesterday, the gold market opened at 4068.6 in early trading and the market fell first. After the daily low reached 4054.6, the market rose strongly. After the daily high reached 4133.3, the market continued to rise. Qingmei fell back strongly during the intra...

market analysis2025-11-20

Short-term operation guide for major currencies

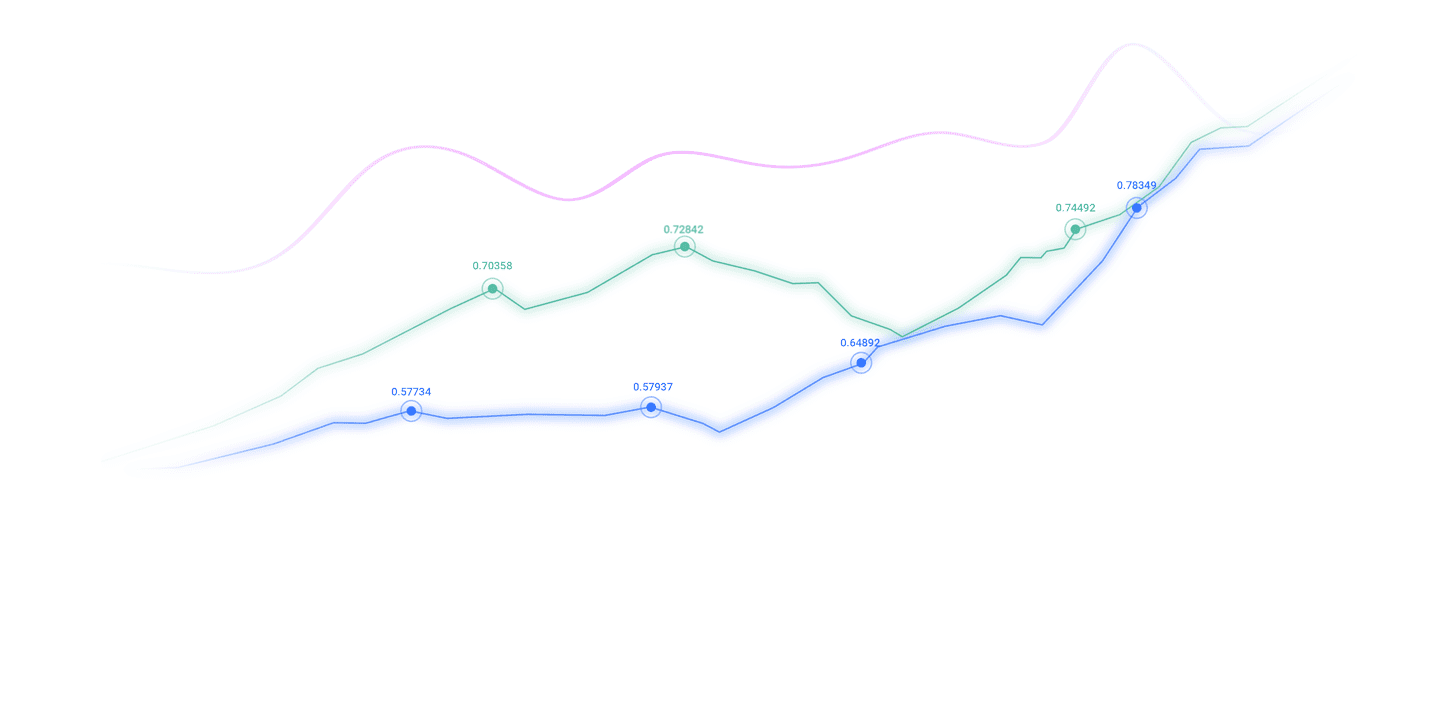

From a technical point of view, the U.S. dollar index‘s rise on Wednesday was blocked below 100.25, and its decline was supported above 99.45, which means that the U.S. dollar is likely to maintain an upward trend after a short-term decline. If the U.S. index ...

market analysis2025-11-19

Analysis of the latest trends in gold, US dollar index, Japanese yen, euro, Brit

In terms of basic news, on Wednesday (November 19), the U.S. dollar index was basically stable, currently around 99.60; spot gold was around $4,074 per ounce. On this trading day, investors will focus on the minutes of the Federal Reserve meeting, which are ex...

CATEGORIES

News

- USD/CAD may face pullback pressure after hitting six-month high

- Euro/USD is coming up with rising opportunities, weak U.S. labor market weakens

- Practical foreign exchange strategy on September 3

- The dollar stands at the 99 mark, and the Fed’s “third leaders” support further

- 10.20 Gold and crude oil today’s price rise and fall trend analysis and latest l

- Guide to short-term operations of major currencies on September 9