Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-11-04

The U.S. dollar index remains below the key psychological level of 100 as the ma

During the European trading session on Monday (November 3), the U.S. dollar index rose slightly, reporting at 99.8780/960, an increase of 0.17%. Prices were relatively calm during the trading session, with the dollar supported by higher Treasury yields. At the...

market analysis2025-11-04

11.4 Gold fluctuated widely as expected, continuing to sell high and buy low dur

Your profits come from other people‘s losses. In other words, when someone makes a mistake, profits will appear in the market that can be earned, but you cannot calculate or predict how many people will make a mistake next, or how big of a mistake they will ma...

market analysis2025-11-04

Gold's overnight 4027 shorts fell sharply and were harvested as expected, and th

Gold is still in shock as a whole, it just goes back and forth and keeps pulling. Gold has been trending like this for quite some time after the big gold market, so we have to get used to this market rhythm. Don‘t think that as soon as the market rises, it wil...

market analysis2025-11-04

The double hammers on the daily line extend the pressure, gold and silver are st

Yesterday, the gold market opened low in early trading at 3984.8 and then the market fell back first. The daily line reached the lowest position of 3962.3 and then the market rose strongly. The daily line reached the highest position of 4031 and then the marke...

market analysis2025-11-04

A collection of good and bad news affecting the foreign exchange market

1. The U.S. dollar: Positive factors in the long-short game under the divergence of hawks and doves. The U.S. dollar index continued its rise: on November 3, the U.S. dollar index rose 0.07% to close at 99.874. It maintained high fluctuations for two consecuti...

market analysis2025-11-03

The trend of gold on Monday was flat, hovering around the daily line between the

Zheng’s point of view: The trend of gold on Monday was flat, and it revolved around the daily line between the 5th and the 10th. Analysis and interpretation of today’s market (in brief): First, in terms of gold: the daily level is currently in line with the sh...

market analysis2025-11-03

The dollar's rise is paused, and this week's non-agricultural data will be absen

The U.S. dollar (USD) started the new week on a relatively quiet note on November 3 after outperforming its major rivals last week. In the second half of the day, the Institute for Supply Management (ISM) will release the U.S. manufacturing purchasing managers...

market analysis2025-11-03

The release of the U.S. non-farm payrolls in October may be postponed, and the B

XM Forex Market Preview: The release of the U.S.‘s October non-farm payrolls may be postponed, and the Bank of England and the Reserve Bank of Australia will decide this week. XM Chart At 21:30 this Friday, if the U.S. government shutdown ends, the U.S. Depart...

market analysis2025-11-03

Does gold need to be charged VAT?

Does gold need to be charged VAT? Last weekend, an "Announcement on Gold-related Tax Policies" issued by the Ministry of Finance and the State Administration of Taxation resounded throughout the Internet, affecting all online and offline channels. What impact ...

market analysis2025-11-03

Gold has many short-term shocks, and crude oil bulls continue

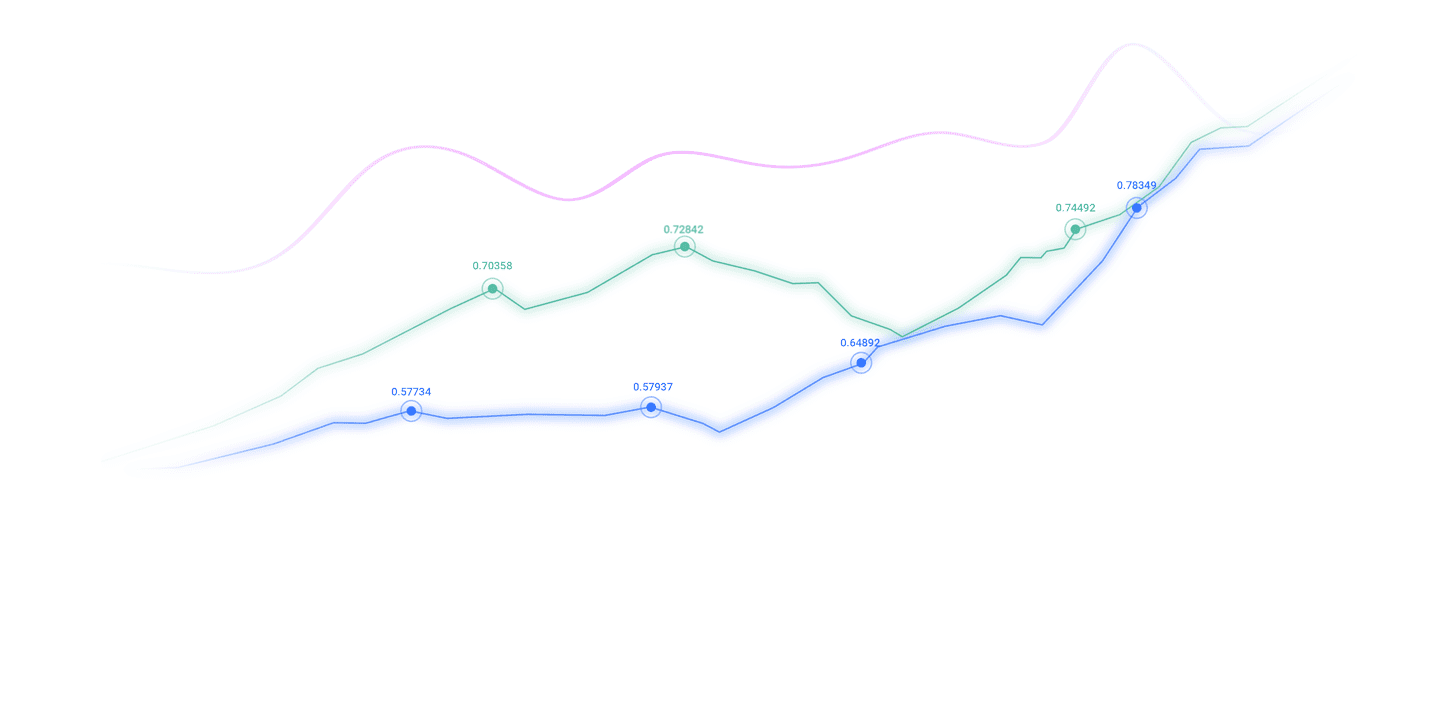

Gold monthly line (long-term long) Support: 3230 weekly line (mid-line long) Support: 3750 daily line (band short) Resistance: 4105 four-hour (short-term) key watershed 3993, prices tend to fluctuate upward in the short-term Crude oil monthly line (long-term s...

market analysis2025-11-03

Gold started the shock

Although the weather in Harbin is not cold enough, it gets dark too early, and it gets dark at 4:30 pm. Why it is said that Shanhaiguan cannot be invested, in fact, it is not just a matter of population. In today‘s fast-paced life, people in the south are stil...

market analysis2025-11-03

Stay bullish and be patient!

After gold fluctuates repeatedly, it will eventually rise. Judging from the current market, it is clear that after breaking through 4028 last week, a deterministic bottom structure was built in one hour, and then it repeatedly fell back to bottom 3960 and 3970...

market analysis2025-11-03

November 3rd practical foreign exchange strategy

U.S. dollar index: The U.S. dollar index‘s rise last Friday was blocked below 99.85, but its decline was supported above 99.40, which means that the U.S. dollar is likely to maintain an upward trend after a short-term decline. If the U.S. index falls above 99....

market analysis2025-11-03

Gold is weakening in the short term, covering the gap and going short first!

Gold opened directly lower in early trading, and gold may begin to weaken in the short term. After gold covers the gap in early trading, short-term pressure can be short-term. The continued momentum of gold bulls is not strong, and it may weaken further in the...

market analysis2025-11-03

The euro is fluctuating, the Fed is "hawkish", can tonight's inflation data be a

On Friday (October 31), the EURUSD was trading around 1.1560, and the market was cautious. The major currency pair struggled to achieve an effective rebound as the U.S. dollar remained strong on the back of multiple positive factors - weakening market expectat...

CATEGORIES

News

- Short-term adjustments begin!

- The dollar has collapsed to the bottom of 7 weeks, and the decisive battle is se

- Guide to short-term operations of major currencies on October 6

- The U.S. job vacancy weakens + bond market volatility slows down, and the pound

- Expectations of a Fed rate cut and pressure from government shutdowns drag the U

- 9.26 The golden triangle fluctuates wide range up and down, waiting for the brea